Our key figures

The financial strength of a major banking group

As a subsidiary of Crédit Agricole Corporate & Investment Bank, we are backed by one of the most robust and biggest banks in Europe.

A unique business model

9th largest global bank and number one retail bank in the European Union, Crédit Agricole has a customer-focused universal banking model that allows it to offer its clients a global, lasting relationship.

With specialised business lines that complement its retail banking activities, Crédit Agricole Group supports its clients’ projects throughout France and around the world.

2025 key figures

Ratings

Crédit Agricole’s ratings attest to the solidity and strength of its customer-focused universal banking model.

The wealth management business line

As Crédit Agricole group’s global Wealth Management brand, our results are published quarterly as part of Crédit Agricole S.A.’s shareholder information.

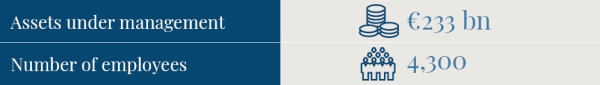

Key figures for Crédit Agricole S.A. group’s Wealth Management Business Line (31/12/2025)